Morgan Stanley Capital International (MSCI) will rebalance its All Companies World Index, MSCI Emerging Markets Index and several of its other most widely used benchmark indices after the close on February 29, 2024.

Fund managers use the Indices produced and maintained by the MSCI as a guide for asset allocation and a benchmark for the performance of global equity funds. MSCI indices are also used to create investment products such as exchange-traded funds.

MSCI rebalances its Indices quarterly to ensure that they reflect an accurate collection of securities and a proper weighting for each security to maintain the objectives of the index.

For Index funds or ETFs that aim to replicate the performance of a particular index, rebalancing can lead them to adjust their portfolios. When an index is rebalanced, the index fund or ETF that tracks it will modify its holdings to match the new composition of the Indices it is trying to match the performance of. All this extra trading activity on a pre-determined day results in increased trading activity and resulting market data rates across the exchanges where those equities are traded.

Pico is uniquely positioned to monitor this change in global market data rates. In addition to providing low latency access to the world’s exchange market data, we also monitor this traffic in real-time with our Corvil Monitoring platform.

Corvil Analytics is the market-leading financial services monitoring solution for trading and market data used by over 100 of the world’s most sophisticated exchanges, banks, trading participants, and service providers.

At Pico, we have one of the largest global deployments of Corvil devices. With 65 Corvil appliances deployed in 30 global colocation sites, we timestamp, capture, decode, and analyze over 400 global market data feeds directly from the exchange handoffs in our PicoNet global network.

This Corvil estate is operated and monitored by a global team of Corvil Certified Experts.

Below are our observations of the global market data volumes after the MSCI rebalance on February 29th 2024.

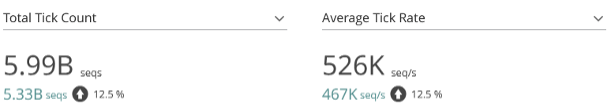

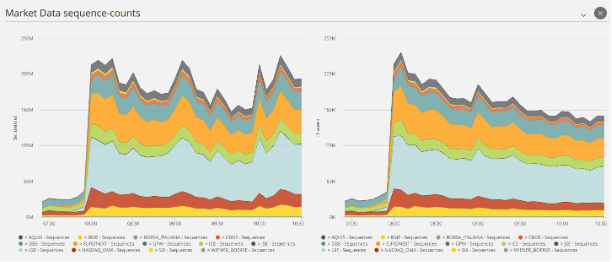

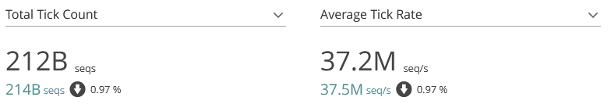

There was an appreciable uptick in market data volumes across EMEA based exchanges in the first hours of trading. The screenshot below from our Corvil Analytics Dashboard shows a 12.5% increase in total Market Data Ticks compared to the previous week's period.

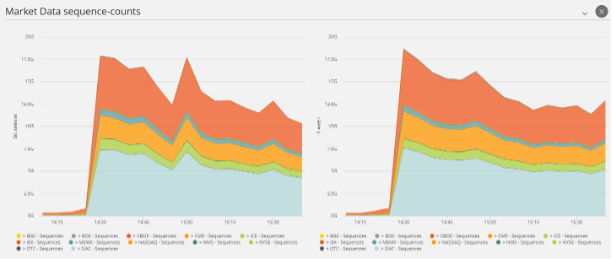

In the below time series we can see this represented by the higher peaks in the graph on the left which shows the morning of the March 1st. The graph on the right shows the comparison period.

We continued to monitor this activity as the day progressed.

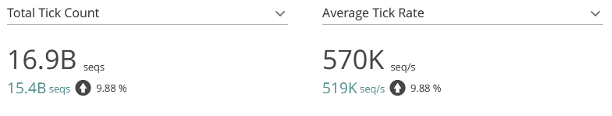

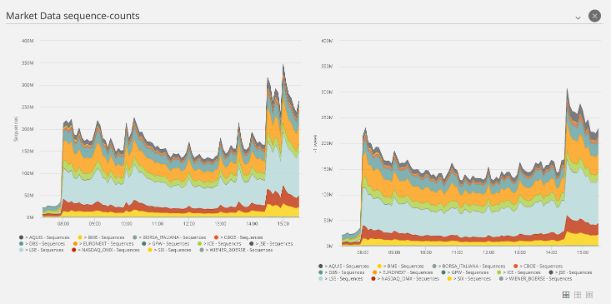

Trading on EMEA markets continued to be higher over the course of the day by 9.88% with a greater than expected uptick at the opening time of US markets.

Interestingly we did not observe a similar increase in traffic on US exchanges in the first hours of trading.

We also did not see a higher volume of market data on February 29th when compared to a non-rebalancing trading day.

To learn more about how Pico provides simple access to ultra low-latency global market data and how Corvil Analytics can help monitor traffic in real-time, please get in touch, or visit https://www.pico.net.