Order Execution Gateway

Powerful direct market access order execution at the lowest latency.

Redline’s Order Execution Gateway provides reliable and ultra-low latency order execution for a wide variety of trading and order routing applications, normalized across equities, options, futures, FX and fixed income markets.

Features

Access Liquidity Faster

API to wire measured in microseconds to nanoseconds depending on use-case

Control Trading Risks

Perform risk checks and track order status while managing portfolio state

Execute Trades More Reliably

Persistence engine enables intraday order state recovery

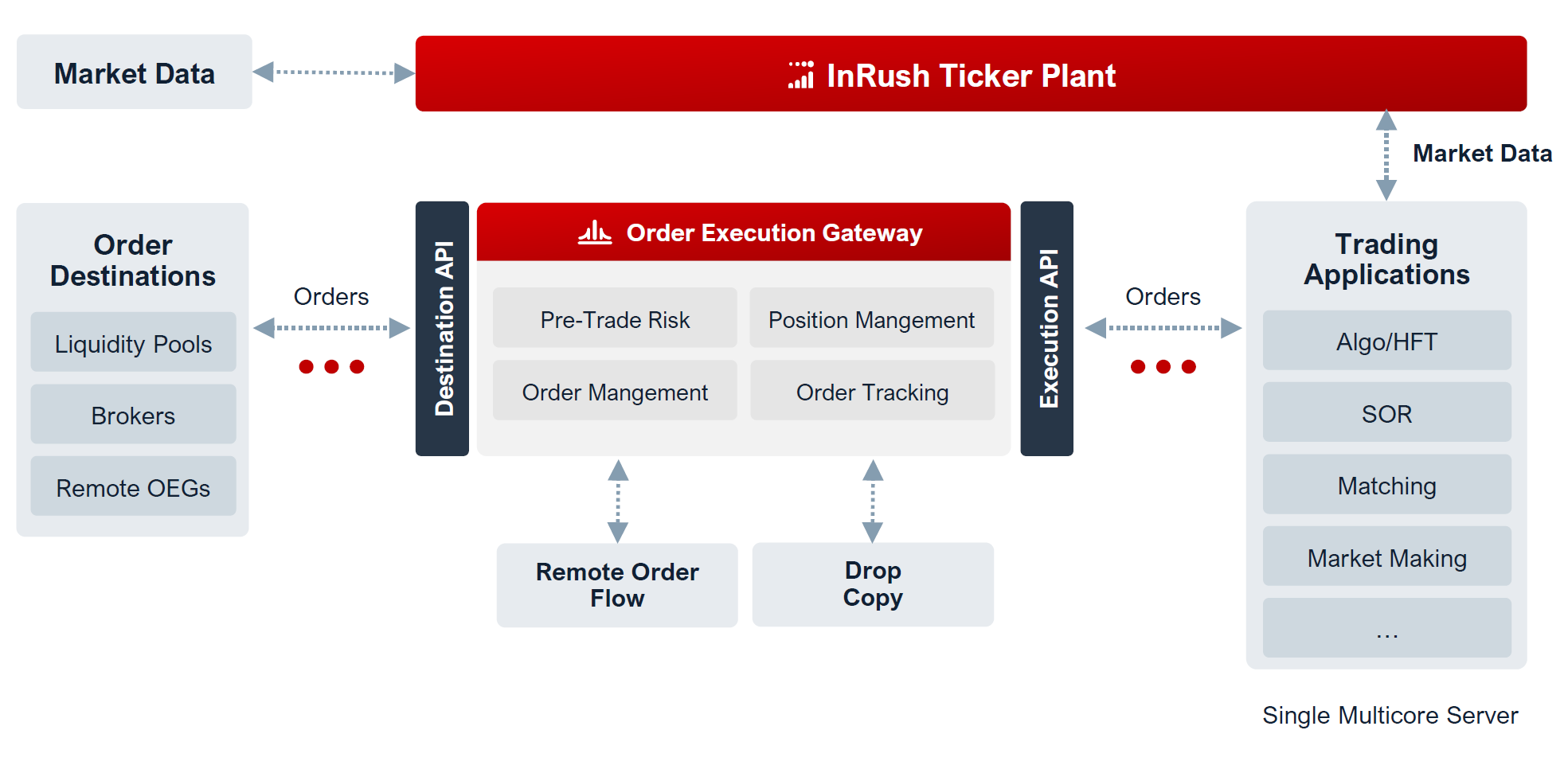

Orders generated by local (in-server) trading applications may be received by the Order Execution Gateway (OEG) using our highly optimized execution API.

This market access solution not only forms and submits each order to the chosen trading venue for direct market access (DMA), but also performs order and portfolio management, real-time order tracking, pre-trade risk checks, and system monitoring.

The results? A more complete execution solution at lower development costs with vastly improved trade execution. Redline’s Execution Gateway has been used by top tier hedge funds, proprietary trading firms, and global investment banks to trade hundreds of billions of dollars daily since 2012.

Customers have utilized Redline’s Order Execution Gateway to power their direct market access trading needs including use cases such as algo trading, high frequency trading, smart order routing, and market making.

Powerful, Modular Architecture for Buy-Side & Sell-Side Use Cases

Directed flow may be sent straight to the chosen destination gateway for order formation and delivery. Destinations can be a direct market access trading venue, liquidity provider, or a broker DMA platform.

Orders may be sent to your smart order router, where InRush™ market data ensures that routing decisions are based upon the most accurate pricing.

Incoming orders may be sent to a brokerage application — receiving client orders, delivering them to the OEG for processing, and sending order updates back to clients.

Orders may even be sent to another OEG server in a remote colocation center to be executed at a trading venue in that co-lo for lower connectivity costs and faster execution.

Capabilities

Flexible Ways to Input Orders — locally via our Execution API or remotely via the FIX Order Gateway

Comprehensive Order Management — maintains and reports multi-level order and order state information to your strategies

Direct and Exclusive Broker Control of Pre-Trade Risk Parameters — across asset classes and easily controlled algorithmically or by a human through an accessible relational database interface

Portfolio and Position Management — reports aggregated client & securities data (e.g. total committed capital, realized gain/loss)

Real-Time Order Tracking — order status at the exchange is reported back to your trading application as desired

Advanced Execution Options — support for market making, mass quotes, RFQs, auctions, and complex orders

Low latency Tuned — with advanced system level optimizations to take advantage of the latest hardware and software available

Maintains multiple session connections

Logging — Transaction Logging of every message sent from/to each venue

Certified — Certified with Direct Market Access Brokers for Equity Markets

Powerful Market Access Architecture

Designed to Flexibly Abstract Order Handling Processes — simplifying the design of your trading and order routing strategies

Runs on the Same Server as InRush and Your Trading Apps — reducing latency, infrastructure footprint, and costs

Alternatively, Runs as an Order Execution Hub — simultaneously processing orders from multiple clients to multiple exchanges

Distributed Gateways — OEGs at many co-los can be linked to minimize exchange connectivity costs, accelerate order execution locally via out Execution API or remotely via the FIX Order Gateway

Readily Integrates Into Your Trading Environment

Execution API Fully Normalized Across Trading Venues and Security Types — to easily send orders and receive responses

Destination API Enables Intelligent Application Design — to direct order flow to the necessary applications

Drop Copy Server — provides normalized FIX-compliant real-time order and execution reports, with high availability built in

Executes Trades with Ultra-Low Latency Performance

API to Wire Measured in Nanoseconds — for the lowest latency use-cases

Tightly Coupled with Our InRush Market Data Platform — or interfaced with your existing market data platform

Supports the Fastest Exchange Message Formats — using binary exchange protocols where available, else FIX protocols

Scalability Built In — easily allocate more compute resources to the OEG as you connect to more exchanges to easily send orders and receive responses

Resilient in Times of Market Disruptions

Persistent Synchronization and Storage — reconnect automatically to the exchange, recover state of the transaction sequence

Multi-day Order State Synchronization — to audit open orders at the exchange (e.g., Good Till Cancel)for the lowest latency use-cases

Certified with Over 100 Trading Venues

Multi-Asset Class Support — connect to equities, futures, options, and foreign exchange venues

Certified with Supported Exchanges — ensuring reliable order delivery and quality support

Support for Optional and Exchange-Required Order Attributes — such as price & time limits, for full control over order handing reconnect automatically to the exchange, recover state of the transaction sequence