Exchange Driven Change Initiatives (EDI’s) are defined as technical changes, introduced by major trading venues, that impact clients who connect to their systems. Pico’s broad range of products all include some kind of interaction with trading venue infrastructure and systems, including Pico Raw and Historical Market Data, Corvil analytics, Redline Software as well as Venue Access connectivity. These offerings support extensive Venue coverage globally, ensuring Pico is uniquely positioned to effectively manage and support these EDI’s.

EDI changes can include massive projects like data center migrations & network infrastructure upgrades, down to smaller upgrades affecting messaging protocol updates and data content changes. Large or small, EDI changes involve the constant looming possibility of systems crashing on a Monday morning, and therefore require a highly rigorous process to validate impact, as well as a careful change management process in preparation for any changes.

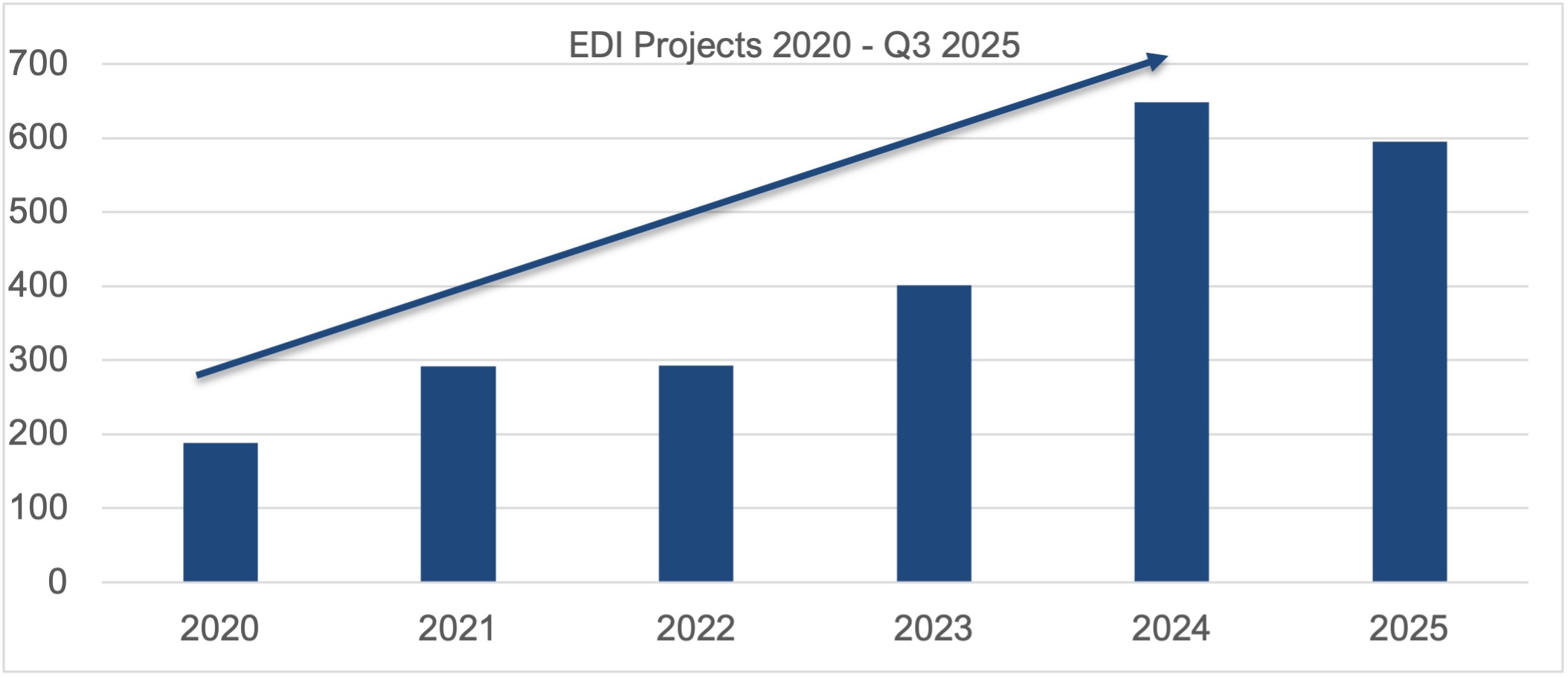

In addition to the significant impact of these EDI changes, the constant rate of mandated changes across global venues continues to be high in 2025.

In 2025, Pico is set to open and track the highest number of EDIs in its history in a single year with 593 new EDI projects identified already through the third quarter of 2025. The number of EDIs managed annually has been increasing year on year due to the high rate of venue change activity as well as Pico’s expanding global venue coverage and product integration initiatives.

EDI Management a priority for Pico – Client Portal Expansion

Pico is committed to ensuring EDI’s are managed effectively and has a global and integrated EDI management process that is intended to promote consistency across product lines and most importantly ensure transparency for Pico Clients.

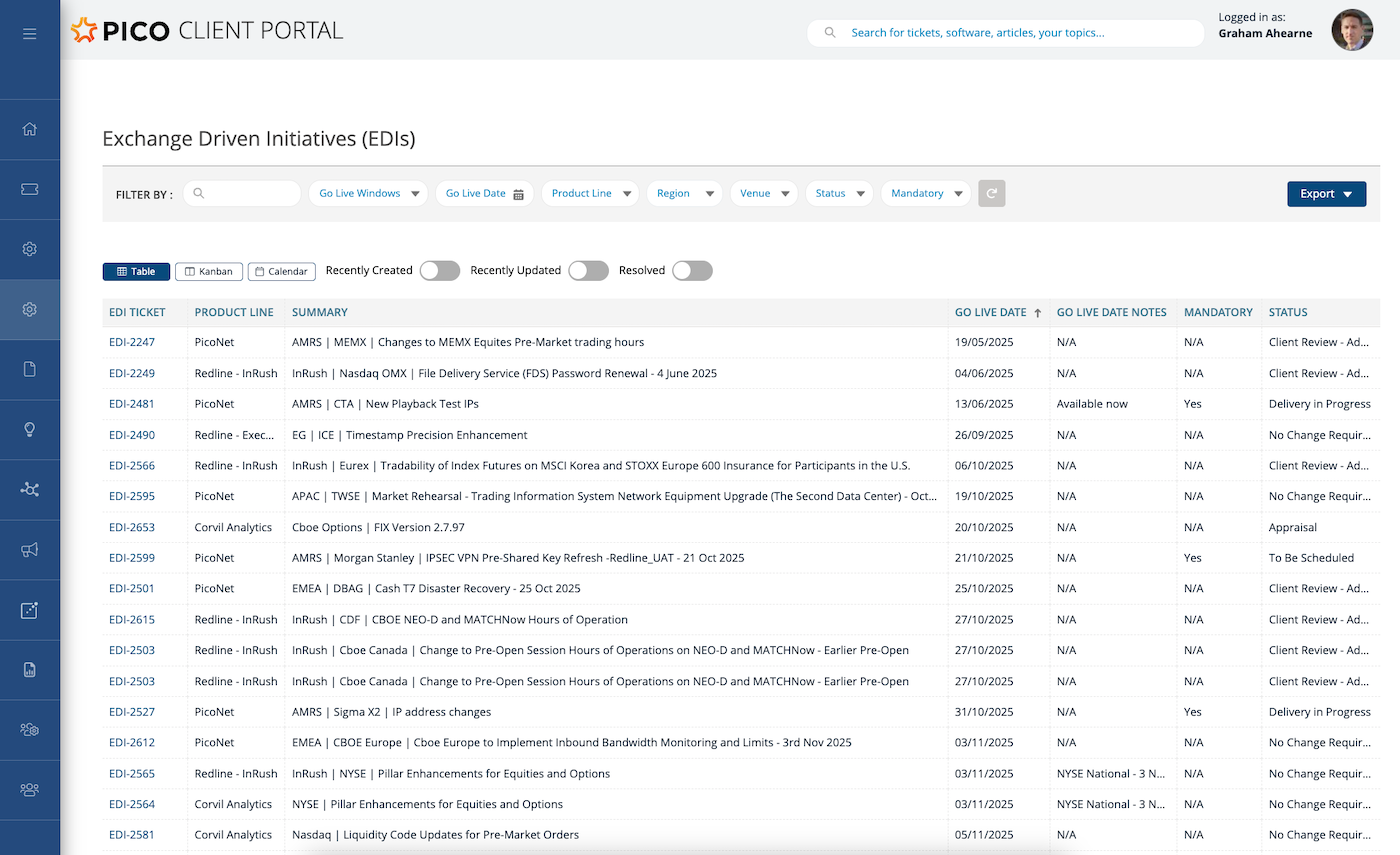

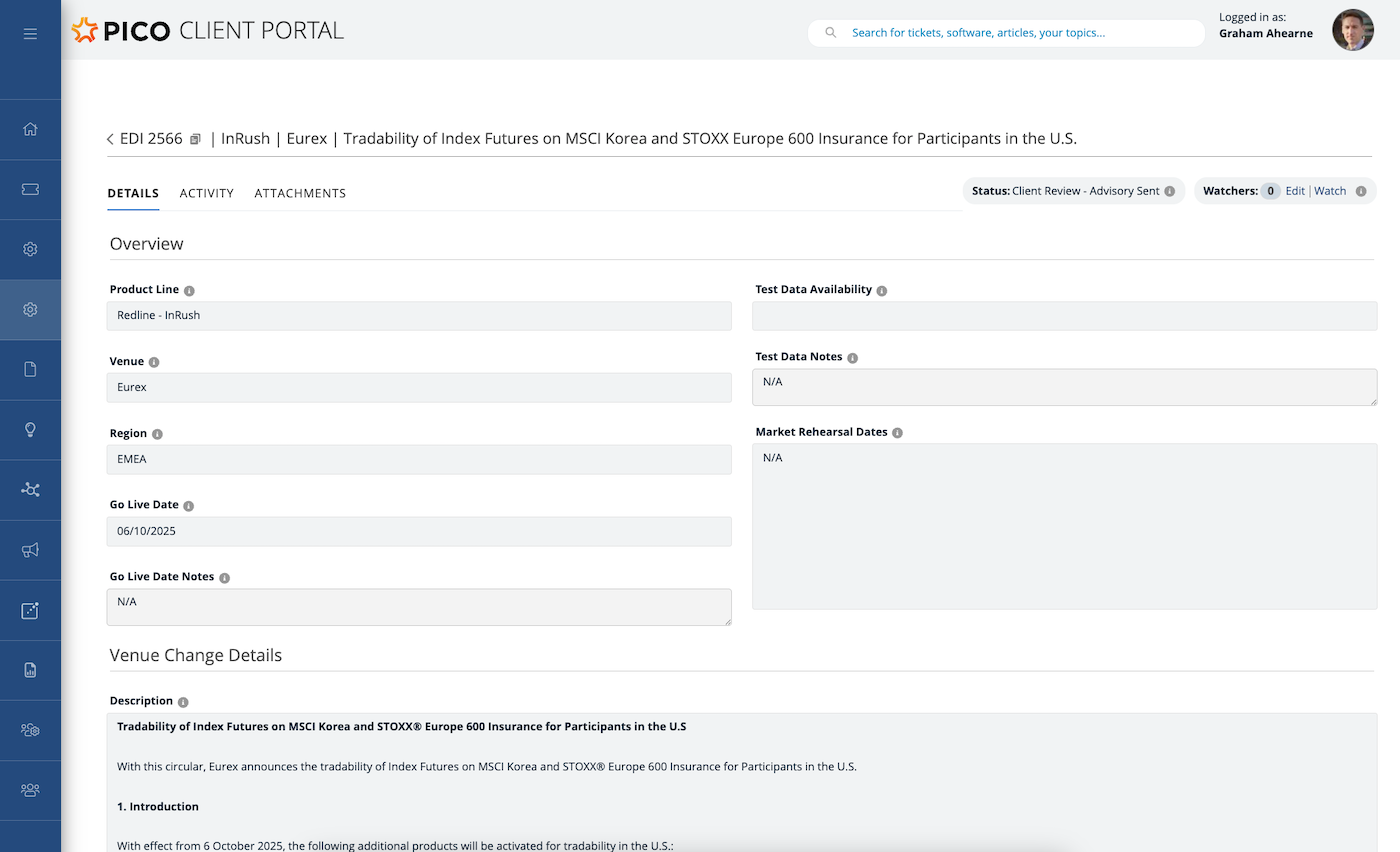

To this end, Pico is enhancing its Client Portal to include EDI project tracking information. This key enhancement is intended to improve Pico Client’s visibility and preparation for these highly impactful and business critical changes by providing Clients with access to a real time interactive view of all inflight EDI projects across Pico’s product offerings including access to information around key dates, product impact assessment, Client action required and project delivery status information.

Pico Client Portal will provide Client’s access to a customizable EDI dashboard allowing Clients to tailor their view based on various data points including Pico Product, Region, Venue, Go live date and status etc.

Upon login Clients will be presented with an overview of all inflight EDI projects (as shown above) which Clients will be able to tailor to show content as required. Alternatively, Clients may switch to a calendar view showing EDIs per go live date across a given month or a kanban view grouping EDIs based on status and stage in the delivery pipeline.

Clients will be able to drill into specific EDI projects for further information including the original venue notification information as well as other data points including Pico Product impact assessment, Client action required and software release versions required to support the change.

2025 EDIs recap and lookahead

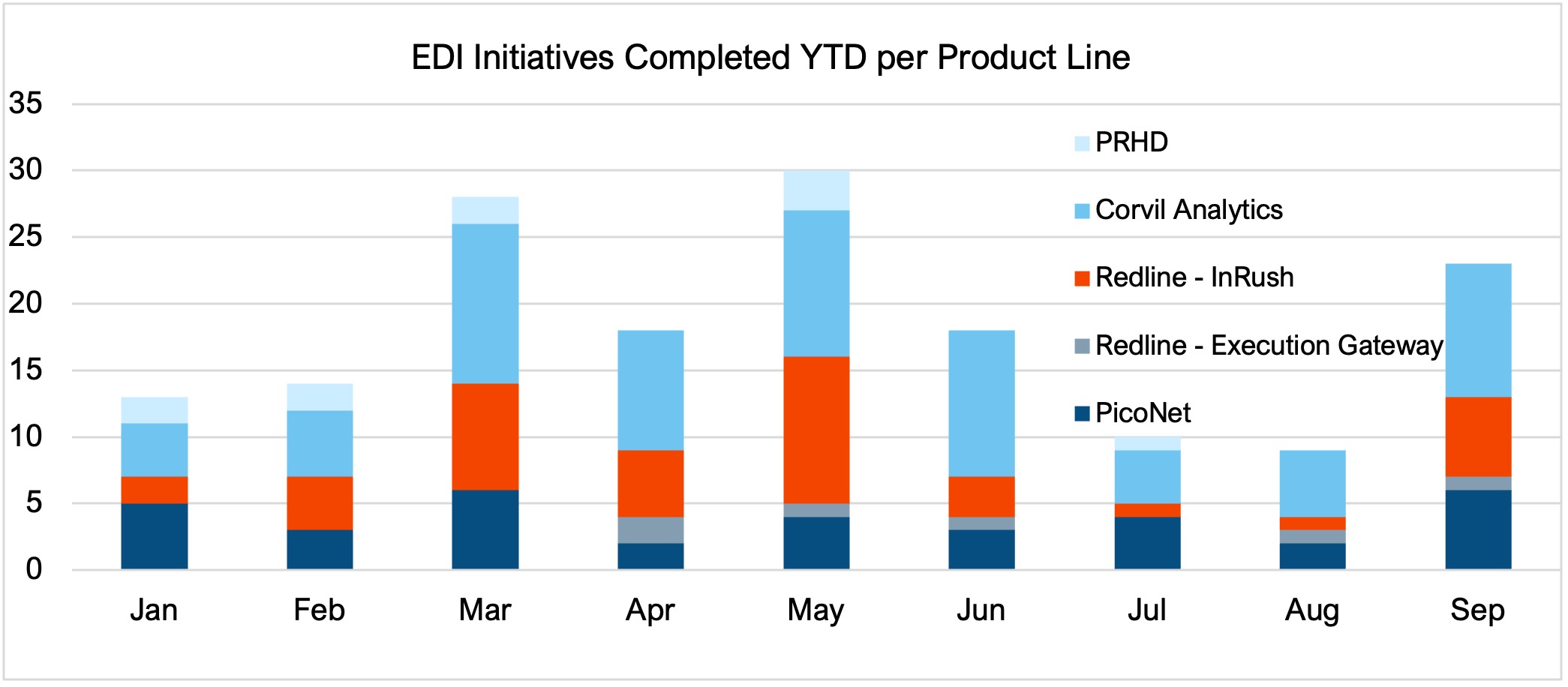

EDI Stats thru Q3 2025:

22,900+ incoming venue change notifications received and assessed

593 changes raised for detailed technical impact assessment

163 new Pico software or service changes identified

163 completed EDIs launched in production impacting a Pico software or service

Key 2025 EDI Projects Delivered

In Q1 2025 several high profile EDI’s impacted virtually all Pico Product lines and required careful management. Highlights include NYSE Arca Options proprietary data feed channel expansion from 14 to 17 channels in February 2025. In March 2025, major platform migrations were successfully completed for both LME in EMEA and Cboe Canada in AMRS.

Throughout Q2 2025, significant EDI projects completed successfully including the Nasdaq OMX Secondary data center migration. This change required new physical connections to be established to the new Nasdaq OMX Port Data Centre as well as various network and software configuration changes required to manage the subsequent phased migration of Nasdaq OMX markets and protocols to the new data center throughout Q2 2025. In AMRS, Coinbase Derivatives also migrated Primary Data Centre to Equinix CH4 and the FINRA SPDS feeds migrated to a new transport protocol and data feed message specification requiring both software and network connectivity changes to accommodate.

Q3 2025 saw a busy quarter with EDI impact across all regions. In July 2025, the Intercontinental Exchange (ICE) decommissioned its legacy OTC channels, unbundling the products previously disseminated on these channels into new products on new multicast groups. This change had market data licensing implications as well as software configuration and network connectivity impacts across a wide range of Clients. In August 2025, Nasdaq launched new version 4.0 of its proprietary Last Sale feeds in preparation of the FINRA led Fractional Share enhancements coming into effect in February 2026.

Q3 2025 closed out with a busy September. In APAC, JPX Group deployed new Tokyo Exchange market data feed specifications. In EMEA, Cboe Europe went live with new Retail Liquidity Provider feeds, Euronext completed launch of Euronext ETF Europe and A2X migrated its Disaster Recovery site to a new data center. Finally, in AMRS, Canadian Stock Exchange went live with new Trading System releases for both CSE2 and CSE markets introducing new Market on Close (MOC) functionality and Nasdaq retired legacy TRF FIX protocol in favor of Native TRF FIX protocol.

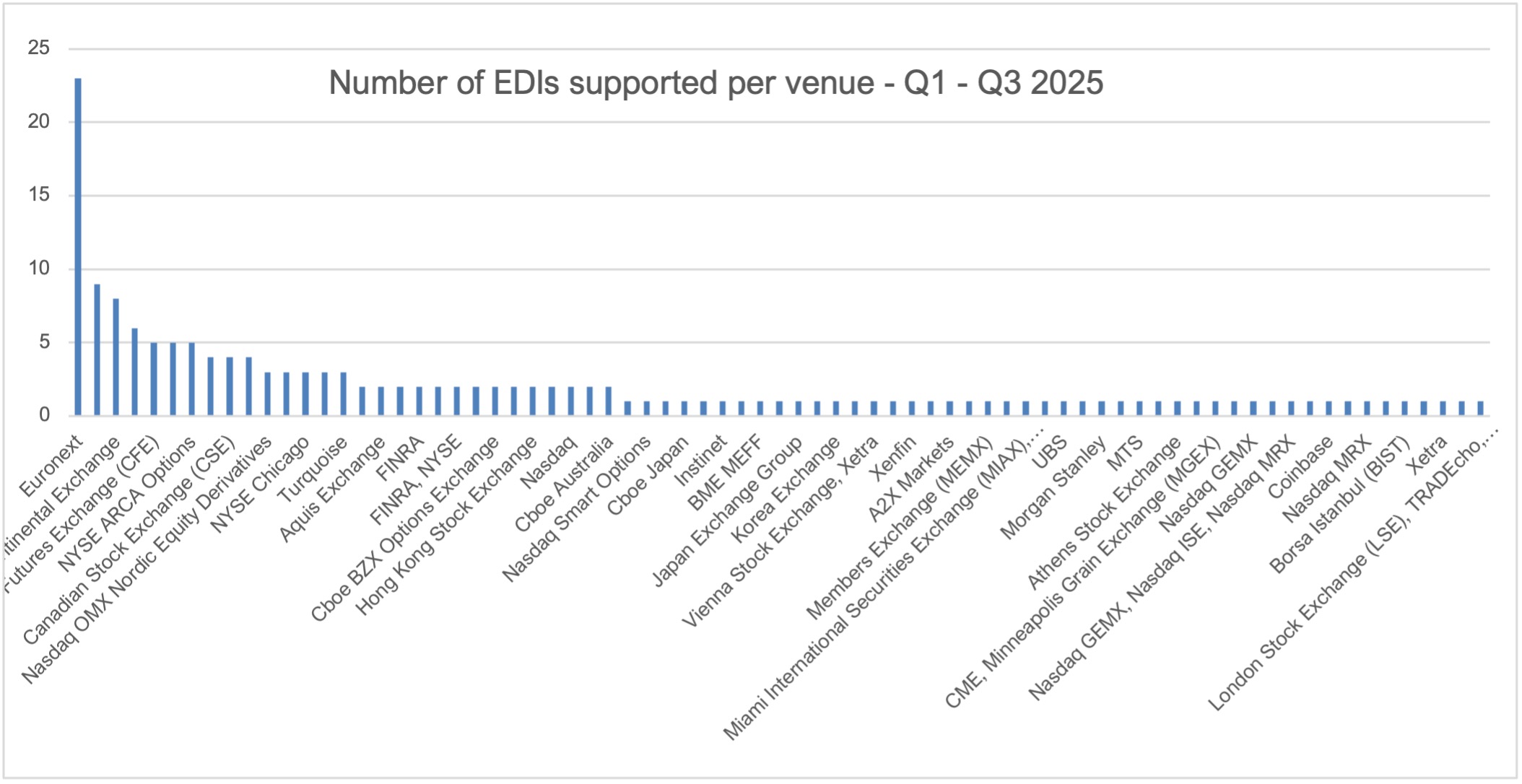

163 total EDIs delivered into production across 70+ venues between Q1 and Q3 2025.

EDI Lookahead

Pico continues to monitor and assess incoming EDIs daily. Pico is managing a number of important EDIs taking place in Q4 2025 as well as into 2026 and beyond.

These initiatives include

Q4 2025

24X National Exchange launch

SIP feed Regulation NMS Mandated Round Lot changes

Nasdaq PHLX Re-platform to Fusion

DBAG Release 14.0

2026 and beyond:

SIP Fractional Share Reporting Enhancements

WAMID Co-location migration

SIP Regulation NMS Mandated Odd Lot Changes

Nasdaq Campus Wide Equalization initiative

Warsaw Data Centre and Re-platform to WATS

SGX Co-Location migration

Impacted Pico Clients will receive further communication regarding delivery status, next steps and action required regarding each of these initiatives over the course of the coming months.